La actualidad de los mercados de la mano de Deutsche Bank en sólo 140 palabras para tratar cada uno de los temas más relevantes y un bonus final.. «¿Y si Esocia hubiese dicho que sí a la independencia?».

Macro

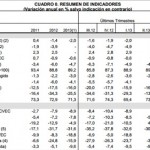

US productivity – Is the Federal Reserve losing faith in hardworking Americans? This week’s simultaneous downgrades to estimates of output growth and unemployment next year suggest as much. The latest forecasts show unemployment falling to 5.5 per cent by the end of 2015. Assuming a constant participation rate this implies a 1.5 per cent increase in the number of people in work. Given economic growth is forecast to be 2.8 per cent, productivity as measured by output per person therefore rises by just 1.3 per cent. That is half the average in the decade before the financial crisis and down from 1.7 per cent on Fed forecasts made three months ago. Such declines matter because anaemic productivity spurs inflationary pressures at lower levels of output growth. Is this why all but three committee members now expect at least three rate hikes next year?

Strategy

Calpers quits – Hedge fund sceptics are revelling in Calpers’ decision to completely exit the asset class. Other pension and endowments should not automatically follow. Calpers legitimately complains about being too big to achieve meaningful scale. But it is unfair to cite complexity (imagine GE divesting turbines because they are complicated) or cost (hedge funds are expensive but the industry’s 70 basis point average monthly return net of fees over twenty years remains ahead of the MSCI World, with half the standard deviation and four times the Sharpe ratio). What is more, it is both the most tempting and potentially worst time to exit hedge funds when equity markets appear stretched. To illustrate this consider that since 1994 the industry has generated just half the return of global stocks during up-months. But in down-months hedge funds only fall a fifth as much.

Stocks

Sony vs Netflix – A competition for readers who fancy themselves as stock pickers: over twelve months would you buy Netflix, which launched its streaming video service across Europe this week, or Sony, which on Wednesday issued a sixth profits warning in two years? It’s tricky. The latter’s market cap has collapsed to below $20bn, a third smaller than Netflix, despite making ten times the revenues and gross profits. Sony also trades below book value and only five years of forecast ebitda buys you its entire enterprise value. Netflix’s ev/ebitda ratio meanwhile is an eye-popping 50 times. Value is ultimately determined by returns to shareholders though. Sony has not generated a single yen of net earnings this millennium. Netflix’s free cash flows are expensive but have a five year compound annual growth rate of 85 per cent. Answers to the usual address please.

Finance

EM debt – The shadow of rising US rates looms large over emerging markets once again – whether as nine straight days of losses for developing world stocks or the sharp move lower in currencies versus the dollar recently. Will darkness envelope EM debt too? Yield hungry investors bought record amounts of EM corporate debt in recent years. Outstanding international debt securities issued by EM non-bank companies doubled in the last four years to over $1tn. But debt issued in good times may come due in not so good times. BIS data show that EM companies face redemption payments rising from $90bn next year to $130bn in 2017 and 2018. And with two-third of these repayments coming due denominated in dollars, a stronger US currency is a significant potential headwind. Whatever definition of ‘considerable time’ EM investors prefer, it surely does not extend to 2018.

Digestif

Scotland – It’s not only pro-independence voters who are crying into their Irn-Brus this weekend. No doubt Lloyds was looking forward to calling itself the longest surviving major bank brand in the United Kingdom – now those bragging rights remain with Bank of Scotland. Likewise the Royal North Devon Golf Club will be cancelling an order of new stationery that boasts of being the oldest course in the UK – Scotland’s Musselburgh Old Links retains that honour. And surely the University of Liverpool was keen to change its primary admissions pitch from «the third top city to visit in the world – Rough Guides» to «the UK’s oldest students union». Alas, Edinburgh University carries on with that title. That said the Atholl Highlanders in the employ of the Duke of Atholl would have remained Europe’s only legal private army no matter which way Scotland voted.