¿Qué podemos esperar del mercado esta semana? 140 para tratar las cuatro áreas clave para tus finanzas y la economía global más un «Y si…»

Macro

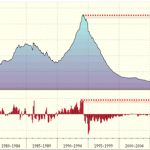

Chinese growth – Output growth at a five-year low! screamed the headlines this week. But China’s 7.3 per cent third quarter expansion is no hard-landing. Growth is gliding lower having averaged 7.6 per cent over the last nine quarters and even at 7 per cent next year China will still provide a quarter of projected global growth. Besides, demographic change makes comparisons to the 2000-2010 era of double-digit growth misguided. Then, the working-age population grew by 10m people annually. It is declining by 2m a year now. And current output growth is not bad considering credit expansion is slowing sharply. Indeed, the quarter’s 2.3tn yuan increase in social financing was 40 per cent smaller than last year – the biggest decline in a decade. A narrowing gap between credit and nominal output growth even at the expense of a modest slowdown is good news.

Strategy

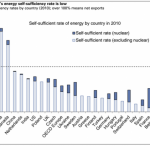

Oil capex – Some blame management incentives for weak capex – executives favouring buybacks instead. True, at 70 per cent of cashflows US non-financial investment is about as low as it gets. But for many energy companies it is hard to stop spending. They kind of have to find, transport and refine oil and gas or investors notice. That costs money. Hence in America the energy sector is now the source of almost a third of S&P 500 capex, according to published accounts. Meanwhile related equipment makers, for example, make up a fifth of all received capex, according to national accounts data. Which is why falling oil prices are no longer the cause for celebration across America they once were. Deutsche’s strategist has just lopped three dollars off his S&P 500 earnings forecast for 2015. Three quarters of that is down to oil.

Stocks

Cloudy skies – Enterprises have a habit of confounding technology providers. Surely it makes sense to manage computing centrally, thought IBM decades ago. But firms preferred a box under every desk. More recently many thought companies would never risk the running of essential software from the cloud. Wrong again! Recent results from IBM, Microsoft, SAP, Citrix and Oracle suggest the move skyward is accelerating faster than anyone expected. IBM’s data software revenues, for example, were up 2 per cent in the first quarter, down 2 per cent in the second and fell 5 per cent in quarter just gone. And that decline includes maintenance fees, which suggests licence sales growth is suffering even more. Indeed aggregate compound annual revenue growth for the five companies above has only been above 1 per cent once in the last 13 quarters. These clouds are not clearing.

Finance

Traders versus bankers – Volatility – friend or foe? A theme through this results season is banks welcoming the return of volatility. Fixed income trading desks have particularly enjoyed the tail wind with the large US banks reporting revenues up a fifth over last year. But Credit Suisse reminded investors yesterday that not all business lines enjoy a roller-coaster ride. Corporate financiers for instance have revelled in the calm conditions of the last two years as they boosted capital raising and M&A activity. In fact the combined underwriting and advisory revenues for the eight largest investment banks rose from a quarter to a third of their trading revenues. However, historical correlations suggest that a ten point rise in the VIX can shave 10 per cent off these revenue streams for these eight banks. Volatility is welcome on trading floors but bankers much prefer calmer environs.

Digestif

Wag the Dog – «There is no B-3 bomber» was Robert De Niro’s Machiavellian lesson in getting people talking about a story by denying it. Likewise, ECB denials of a corporate bond buying plan certainly got markets talking. If it happens, this will be the central bank’s third plan B after targeted LTROs and ABS purchases – plan A being buying sovereign bonds. How much ammunition does plan B-3 offer? Perhaps €550bn, after excluding financial and non-euro area issuers from the iBoxx EUR investment grade index’s €1.5tn universe. One potential pitfall is that relative to GDP, this pool is overweight French issuers (one-third) and short German paper (below a quarter). The sector split is similarly skewed with one-third from utilities. Maybe buying the debt of state-owned utilities – the biggest issuer EDF is 85 per cent government held – will break taboos about outright government bonds purchases.